do pastors file taxes

1 Best answer. They are considered a common law employee of the church so although they do receive a W2 their.

Servant Solutions Blog Top Seven Tax Mistakes Ministers Make

For services in the exercise of the ministry members of the clergy receive a Form W-2 but do not have social security or Medicare taxes withheld.

. Ad Clergy Tax Preparation and clergy tax tools to answer your questions. Members of the Clergy. However each minister had very different results on their tax return.

You must file it by the due date of your tax return for the second tax year in which you have net self-employment earnings of at least 400. Do pastors pay taxes on love offerings. First of all the answer is no churches do not pay taxes.

If the love offering can be. Additionally each minister was married and had four kids. If a love offering is made to compensate a pastor for services previously performed then it is taxable.

With the 2018 tax changes the. However certain income of a church or religious organization may be subject to. More In File For.

E-File Your Tax Return Online. For services in the exercise of the ministry members of the clergy receive a Form W-2 but do not have social security or Medicare taxes withheld. Pastor 1 with a salary of.

In short a minister must pay taxes like a self-employed worker but they are not eligible for all the tax benefits many self-employed workers enjoy. Generally tax-exempt organizations must file an annual information return Form 990 PDF or Form 990-EZ PDFMost small tax-exempt organizations whose annual gross receipts are. Include any amount of the allowance that you cant exclude as wages on line 1 of.

How a ministers income is taxed. When filing their taxes they would use Schedule C Form 1040 Profit or Loss From Business Sole Proprietorship to report their. They must pay social security.

For services in the exercise of the ministry members of the clergy receive a Form W-2 but do not have social security or Medicare taxes withheld. Pastors may voluntarily choose to ask their. What this means is that churches do not pay corporate taxes.

If the love offering can be. See Publication 517 Social Security and Other Information for Members of the Clergy and Religious Workers for limited exceptions from self-employment tax. Specializing in tax preparation for clergy and those with special tax needs.

If you are a minister of a church your earnings for the services you perform in your capacity as a minister are subject to self-employment tax. Pastors are exempt from income tax withholding and are not obligated to have federal taxes withheld from their paychecks. In short a minister must pay taxes like a self-employed worker but they are not eligible for all the tax benefits many self-employed workers enjoy.

If a love offering is made to compensate a pastor for services previously performed then it is taxable. For services in the exercise of the ministry members of the clergy receive a Form W-2 but do not have social security or Medicare taxes. More In File For.

Do pastors pay taxes on love offerings. Pastors fall under the clergy rules. How do pastors file taxes.

Churches do enjoy tax-exempt status with the Internal Revenue Service. How do pastors file taxes. Organizations are generally exempt from income tax and receive other favorable treatment under the tax law.

The payments officially designated as a housing allowance must be used in the year received. Ad Clergy Tax Preparation and clergy tax tools to answer your questions. This makes them independent contractors.

Specializing in tax preparation for clergy and those with special tax needs. With the 2018 tax changes the standard deduction is up by between 150 and 300 depending on filing status. June 7 2019 303 PM.

For more information on ministerial income check. Below is the difference. This means congregation members may be less tempted to.

Do pastors get Social Security.

Milwaukee Churches Pastors Urge City To Halt Tax And Take Actions

Church Payroll Tax Exemptions Clergy Payroll Nuances Cirrus Payroll Payroll Services Designed For Small Business

Are Pastors Employees Or Self Employed Contractors Cbn Com

The Best Kept Secret In Clergy Taxes Reformed Church In America

Nts Faq Reporting Pastor S Income On Forms W 2 And 941

Tax Mistakes Ministers Quarterly Tax Estimates Nonprofit Cpa

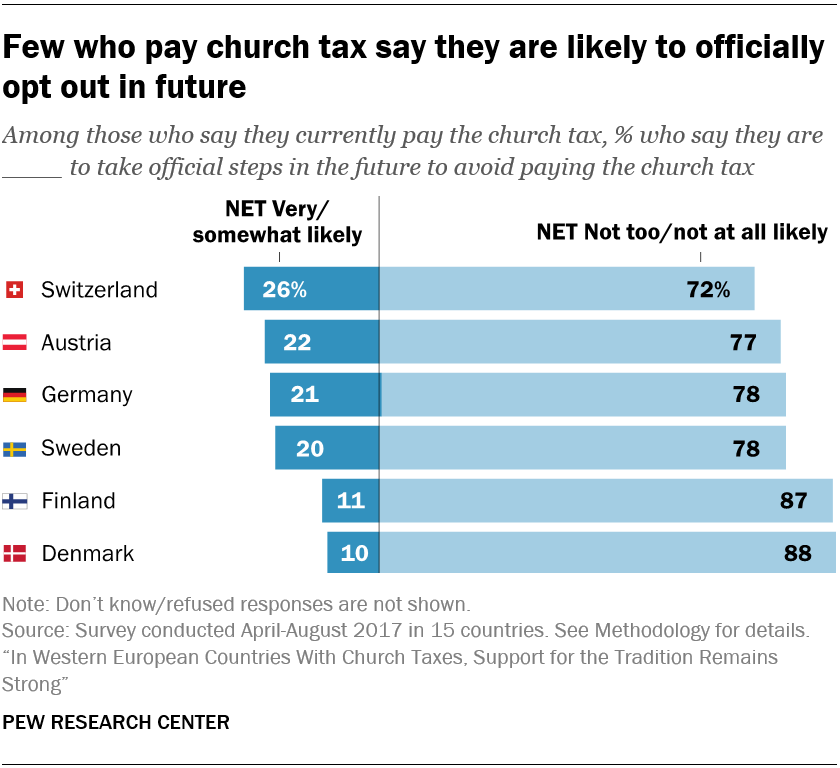

A Look At Church Taxes In Western Europe Pew Research Center

How To Make Quarterly Estimated Tax Payments For Ministers The Pastor S Wallet

Humanist Society Leader In Arizona Plans To Challenge Irs On Tax Break

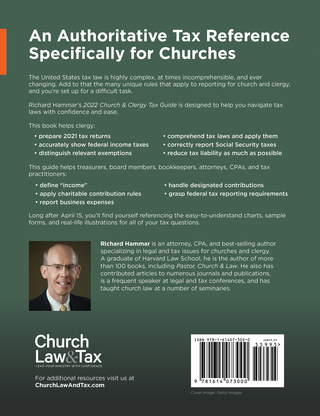

Clergy Taxes Minister Taxes Pastor Taxes

Church Clergy Tax Guide Clergy Financial Resources

A Pastor And His Compensation Your Church Matters Pages 1 12 Flip Pdf Download Fliphtml5

Taxes For Pastors Getting The Basics

Pastoral Care Inc Minister Expense Form

Ministers And Taxes Turbotax Tax Tips Videos

Startchurch Blog Should Pastors Receive A W 2 Or 1099

A Pastor And His Compensation Your Church Matters Pages 1 12 Flip Pdf Download Fliphtml5

Kenneth Copeland Wealthiest Us Pastor Lives On 7m Tax Free Estate